Have you been thinking about getting a payday loan? Join the crowd. Many of those who are working have taken out these loans nowadays, in order to continue until their next paycheck. But do you really know what payday loans are? In this article you will learn about payday loans. You may learn things you never knew before!

Pay off the loan in full as soon as possible. You will be given a due date, and pay close attention to that date. The sooner you pay off the loan in full, the faster your transaction with the payday loan company will be completed. This will save you money in the long run.

Before taking out that payday loan, make sure there are no other options available to you. Payday loans can cost you a lot in fees, so any other alternative could be a better solution to your overall financial situation. Look to your friends, family, and even your bank and credit union to see if there are any other potential options you can make.

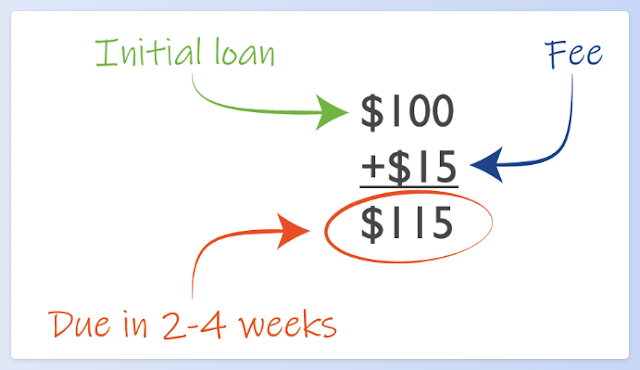

The fees associated with payday loans include many types of fees. You will need to know the interest amount, penalty fees, and whether there are application and processing fees. These fees will vary between different lenders, so be sure to look into different lenders before signing any agreements.

Learn about late payment fees. When you opt for a payday loan, you have to pay it by the due date; This is vital. Read all the details of your contract so you know what the late fees are. The penalty associated with a payday loan is fairly steep.

Watch for lenders who keep rolling over your finance charges every pay period. This makes it impossible to repay the loan because what you are essentially paying are fees and charges. It is not uncommon to pay more than four times the value of the loan before all is said and done.

Learn about the lender's terms before agreeing to a payday loan. It is not uncommon for lenders to require stable work for a minimum of 3 months. The company must feel confident that you will repay the cash in a timely manner.

Don't choose a payday loan provider without doing some comparison work. Many payday loan companies have lower rates than others and some may not charge a fee for taking out the loan. Some payday lenders may offer you money right away, while others may make you wait a few days. If you review different loan programs, you are sure to find a loan that suits your needs.

Make sure to apply directly to lenders when applying for a loan online. Some websites collect your information and try to connect you with a loan lender; This can be risky because you do not know who you are giving your personal information to.

If you've ever had trouble with payday loans, get some help. Their free services can help negotiate an interest rate consolidation or lower to get you out of the evil payday loan cycle.

Make sure you know the due date by which you need to repay your loan. Payday loans have very high interest rates, and providers often charge hefty fees for late payments. Therefore, you need to ensure that your loan is repaid in full on or before the agreed repayment date.

Know the fees for payday loans before you get them. Sometimes, fees can be as high as 25 percent of the money you borrow. You may have to pay 300-500 percent APR. This rate increases if you do not pay during the next payment cycle.

Make sure you keep up with any rule changes regarding your payday loan lender. Legislation is always being passed that changes the way lenders are allowed to operate, so make sure you understand any rule changes and how they will affect you and your loan before signing a contract.

One important piece of advice for anyone considering a payday loan is whether or not the lender you are working with is licensed to do business in your state. Each state has its own laws and licensing. You should choose a lender that can work in your state.

Getting a payday loan is very easy. Make sure you go to the lender with your most recent payment receipts, and you should be able to get some money pretty quickly. If you do not have your last pay stubs, you will find it very difficult to get a loan and may be refused.

Getting payday loans is very dangerous. This could cause issues with your balance or your bank if you don't handle it the right way. Always remember that payday loans are not extra money. You will have to pay more than this amount in the future.

Do your research when it comes to payday loan companies. Even though you feel like this is an emergency and you don't have time to research options, think twice! Payday loans are received very quickly. Often, funds are available almost immediately. Check online for the lowest loan rates, look for complaints about lenders on the Better Business Bureau website, and find out if you have any other ways to get money so you can avoid the high cost of a payday loan.

With so many payday loans available, you should always compare interest rates before choosing which one to apply too. Payday loans have significantly higher interest rates, some still higher than others. Try, and choose a payday loan that offers the lowest interest rates possible, so you can save some money.

As mentioned at the beginning of the article, people are taking out payday loans more and more these days in order to survive. If you are interested in getting one, it is important to know its ins and outs. This article has given you some important tips about payday loan.